Cookies Will Crumble: What B2B Marketers Need to Know About Recent Changes in Data Privacy

The evolving state of data privacy

We all know that when we use the Internet and apps on our phones, our behaviors and information are often tracked and stored. Marketers—B2C and B2B alike—share and use that data to get in front of us and to entice us to engage. Fortunately, for our protection, “data privacy” governs the way our information is collected, shared, and used.

Despite the quickly changing regulations meant addressing data privacy, concerns are keeping pace. In fact, a study by SAP conducted in 2017 found that 79% of consumers will ditch a brand if they learn their personal data is being used without their knowledge. It’s likely that number has grown even higher today, especially in B2B.

A few recent and key data-privacy regulatory changes are highly relevant to marketers, since in practice they are “forcing” marketers to adapt the way they work.

The removal of third-party cookies

Following Apple’s removal of third-party cookies from Safari last year, Google announced its plans to end (and not replace) third-party cookies within Chrome, the number-one browser in the U.S. Both B2C and B2C marketers have historically relied on third-party cookies within browsers like Google to track their buyers and measure the performance of their digital marketing campaigns.

Stricter app opt-Ins

Earlier this year, Apple also announced changes during its latest iOS 14.5 release that make it more difficult for mobile apps to collect user data. The software release will require every user to “opt in” to sharing their IDFA (aka personal data), and they’ll need to do this for every app they use.

Continued evolution/adoption of regulations

Data and consumer privacy regulations in the US and abroad continue to evolve, including the latest iteration of the California Consumer Privacy Act (CCPA), which regulates how global businesses can collect from, and use data about, California residents. This is part of a trend towards stricter regulations that many industry experts believe will continue; we’re already seeing similar policies introduced in Florida, Virginia, New Hampshire, Illinois, Washington and the most recently, in New York state.

These kinds of regulatory changes are not just pertinent to the US. Similar data-privacy regulations, including GDPR in the European Union, continue to gain support internationally.

What do these data privacy changes mean for you?

How, exactly, do those changes effect marketers? First, advertising tactics that have historically relied on third-party cookies and in-app tracking will show a significant decline in performance, as the ability to identify and track buyers goes away. As major companies like Google no longer allow the use of individual users’ browsing behavior and history to push targeted ads, marketers will lose a major means of gaining buyer intel and strategically getting in front of buyers online.

Stricter app opt-ins from major players like Apple also makes it harder for marketers to target buyers. Apps are going to be more active in notifying users and asking permission to collect data, while their tracking abilities will become more regulated and curtailed. This will make it harder for brands to target iPhone users with personalized ads.

Finally, the ever-changing data-privacy landscape means that marketers will need to be agile and adaptable in how they reach out to buyers. And they’ll likely need to be more sensitive. With more and more information about data privacy in the news, buyers are increasingly aware about data usage and their rights to have their data secure and private. As a result, buyers will demand more transparency into exactly what kinds of personal data is collected and used by advertisers.

In the end, while buyers may be happy receiving fewer ads and communications overall (while “opting in” only to the brands they choose), marketers like you may wonder how to navigate the shifting landscape.

Are marketers prepared for the challenge?

According to a recent study conducted by eMarketer, marketing and communications organizations vary in their level of preparedness for these changes, with brands believing they are least prepared; in fact, less than 50% believe their companies are prepared.

Since the eMarketer poll didn’t distinguish between B2B and B2C, we were curious about how B2B marketers in particular are feeling. So we informally polled SCHERMER’s B2B clients and activation partners (e.g., media partners, data partners, etc.) to find out—incentivized by freshly baked and delivered cookies, of course (pun intended).

B2B marketers feel somewhat prepared

Respondents reported feeling well prepared for changes to third-party cookies and new data-privacy laws/regulations. Specifically, nearly 90% of the partners we polled reported high confidence that they and their firms are keeping up with the latest changes regarding data privacy and that their current marketing efforts have not been impacted at all by data-privacy issues in the last year. And 80% indicated that they expect little to no impact from data-privacy issues to their marketing efforts in the next 12 months.

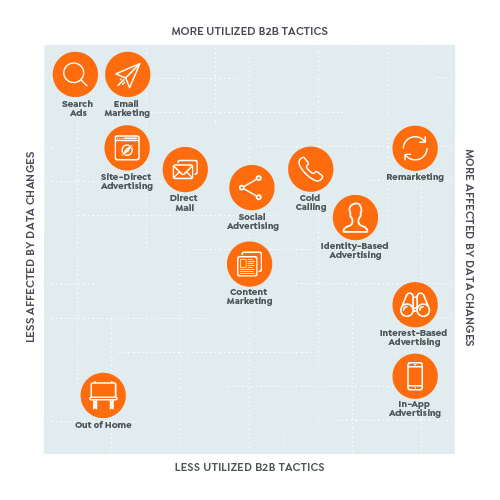

In truth, the impact on B2B marketing varies significantly by tactic, as illustrated in the chart to the right. But in most cases, we are seeing less of an impact on B2B marketing than we see in B2C.

Two reasons why

First, B2B marketers already rely more heavily than their B2C marketing counterparts on first-party data because of longer sales cycles, and because much of B2B is driven by relationships and sales teams. Furthermore, many B2B marketers had already invested significantly to build out their own buyer data well before these latest data privacy changes even become commonplace.

Second, B2B buying processes are longer and more complex than those involved in most B2C purchases. Typically, they also involve multiple decision makers—anywhere from five to 10 individuals on average. So some of the tactics most affected by these data-privacy changes—like interest-based targeting and cross-device targeting—are less appropriate and effective when the targets are buying committee than they are when individual consumer. However, continued privacy changes are also likely to impact overall media costs, as marketers move away from non-privacy-compliant targeting solutions and adopt more privacy-safe solutions, making increases in demand and competition for the best tactics inevitable.

What can you do NOW to successfully target buyers?

As these changes roll out, there are a number of things you can do to engage buyers. First and foremost, you should identify which of your current targeting tactics rely on third-party cookies or in-app tracking and look for other, more data-privacy-safe targeting solutions to activate instead. Luckily, increased privacy concerns have led to a number of emerging new opportunities for B2B marketers to consider. The Partnership for Responsible Addressable Media (PRAM), whose members include IAB Tech Lab, announced in April 2021 that it is shifting its focus from developing an alternative for the third-party cookie to supporting three ad-targeting scenarios: 1) user-consented IDs based on email addresses, 2) cohort-level or in-app targeting, and 3) contextual targeting.

1) New user-consent-based universal IDs

There are likely many more data-sensitive tactics in development that will fall into this category, but for now, these are a few to pay close attention to:

The TradeDesk’s Unified ID 2.0 is, in essence, an “upgrade” to cookies that preserves the essential value exchange of relevant advertising while improving consumer controls. It uses consumers’ anonymized email addresses gathered from log-ins to websites or apps. Many industry experts believe this approach will be one of several solutions to eventually replace third-party cookies as an industry standard; it is currently the most dominant approach in the marketplace.

LiveRamp also recently released its cookie-less alternative known as Authenticated Traffic Solution, or ATS. This product connects buyer data (via first-party identifiers) in a marketer’s database with the data of those very same buyers in a publisher’s database (think of The New York Times or The Washington Post), IF those buyers have registered or subscribed with the publisher. In essence, ATS provides buyer-based activation, measurement, frequency capping, suppression, and retargeting without relying on third-party cookies or device identifiers.

PubMatic, Zeta Global, and OpenX are preparing to launch SWAN, an anonymous identifier that serves as a cookie alternative while also letting customers and buyers control ad delivery.

2) Cohorts, Walled Gardens, Retail Media Networks and Email Retargeting

In addition to alternative tracking IDs, the industry is also shifting towards allowing marketers to tap into larger opted-ed in audiences in new, unique ways:

Cohorts, in everyday language, are groups of people who have something in common. Google’s new Chrome solution (currently in trial) in the face of the data-privacy is its Federated Learning of Cohorts, or FLoC. Google’s plan is to replace third-party cookies on Chrome with FLoC, technology that anonymizes users to a degree by putting them into groups, or cohorts, based on common interests reveled. This allows advertisers to target groups of people who may find advertisements relevant—while keeping the user’s personal data undisclosed.

Walled gardens are digital environments that can completely control access to data that users have provided them. For example, Amazon, Google, Facebook, and Microsoft are all walled gardens. The data they have is entirely permission based, minimizing the impact of privacy regulations to their in-channel targeting options. The task for marketers is gaining access to the gardens, and then targeting as accurately as possible their chosen audiences once they’re in.

Retail media networks are rapidly growing market for B2B and B2C brands alike. Similar to the large players labeled in the industry as “walled gardens”, retailers like CVS, Target, Walmart, G2.com, Best Buy, and many other traditionally brick-n-mortar retailers are now starting to allow advertisers and brands new opportunities to tap into and target their opted-in, loyal fanbases in new and compelling ways.

Email retargeting is an approach that marketers can employ within a walled garden and retail media networks like. In fact, using hashed (i.e., anonymized) emails PLUS first-party cookies is a potentially highly effective alternative to cookie-based retargeting solutions. “Hashing” is a fancy term for coding an email address for privacy. Amazon is piloting a way for marketers to email Amazon customers. Facebook and LinkedIn already hash emails automatically when marketers upload customer data, to ensure privacy when they match that data to members on the platform.

3) Contextual Targeting

While these new approaches mentioned above become more commonplace, B2B marketers can always lean more into contextual targeting. This tried-and-true approach can include:

Site-direct media placements with trusted, influential trade publications or websites related to your buyers’ interests.

Digital media purchased via PMPs (private marketplace ad programs). This, in fact, is a popular option already. According to eMarketer, advertisers spent more in PMPs than on the open exchange for the first time in 2020.

Targeting buyers based on the content that they are consuming online. This relies less on knowing WHO the person is, and focuses. on the content they are researching instead.

While all of these newly emerging solutions, like universal IDs or cohort targeting, seem promising, very few have much—if any—market track records that allow marketers to gauge how effective they might be for their own marketing initiatives. So time will tell.

At SCHERMER, we’ve helped:

Target prospects and customers alike via the Trade Desk by activating, hashing, and matching Thomson Reuters’ own first-party buyer data against TTDs audience inventory at scale.

Tap into G2.com review sites’ opt-in and logged-in user data to identify and target prospective accounts and individuals that showed buying intent behavior while comparing and researching competitive solutions.

Empower sales leaders to distribute and amplify our campaign content to their own social networks (LinkedIn, etc.) without relying on any 3rd party targeting data.

All of these targeting strategies helped drive campaign performance and deliver above-typical industry benchmark engagement (CTR) rates.

Make additional investments to guard—and boost—revenue

In addition to exploring the previously described “digital-privacy-safe” approaches to buyer targeting and engagement, B2B marketers can invest in other efforts that can help ensure that data-privacy changes don’t negatively impact the bottom line—now and in the long run.

Set new baselines

First, don’t rely on the baselines you set for previous tactics that relied on third-party cookies. Set new baselines for any and all new tactics. You’ll need to redefine success throughout the selling-buying journey as your strategies and tactics change. With the new tactics, you can’t make apples-to-apples comparisons, so you’ll need new baselines to get an accurate read on how effective post-data-privacy plans and campaigns are performing. For example, a decline in click-through-rate (CTR) may at first glance seem negative; but the resulting leads may be more valuable and have higher conversion rates.

Build your own first-party data

You’ll also want to continue to invest in building first-party data for your own buyers. You can do this a few different ways: manually within your CRM, via your social communities, with a CDP, or even by partnering with a data-compliant data-appending service provider like 6Sense or ZoomInfo. And you’ll always want to keep your existing data up-to-date and useful.

As part of this effort, it’s a good idea to shift your buyer data out of data management platforms (DMPs) and into a customer data platform (CDP), CRM, or alternative first-part data platform to enhance programmatic targeting at scale. Having first-party data available and ready to use in a CDP will enable brands to bring that data to retail networks and walled gardens—to match against their audiences for privacy-compliant targeting options.

Enhance your buyers’ customer experience

Invest in your core buyer experiences. Since some targeting tactics will become less effective due to privacy changes, you’ll want to ensure that your web-based experiences, including mobile experiences, are optimized to convert the visitors who do arrive there.

One way to encourage this is to improve website personalization functionality by investing in and building out a content personalization engine like Optimizely, Path Factory, Google Optimize, Sitecore, etc. If done well, this should improve the engagement (and inevitably conversion rates) of buyers who make it to your website.

In conclusion

Even given all the press and hype about data-privacy concerns and regulations, we believe that current privacy-protection trend provide opportunities for marketers to strengthen their brands—and their company performance.

Marketing effectiveness has always been grounded on relevancy and trust. The recent and evolving data-privacy policy changes will only enable marketers to build a more trusted experience between their brands and their buyers. After all, transparent and safe data collection, along with responsible storage and use, should be a priority for all marketers—B2B and B2C alike. Marketers who make an effort to respect buyer privacy while figuring out how to reach their buyers effectively will promote a much more trusting, valuable experience with their brands.

And in particular, B2B marketers who invest in their own buyer data instead of relying on third-party data will shine in this privacy-safe future.

If you are unsure how to navigate these changes or would like to learn more about how SCHERMER is helping our amazing B2B clients adapt, we’d be more than happy to chat with you.